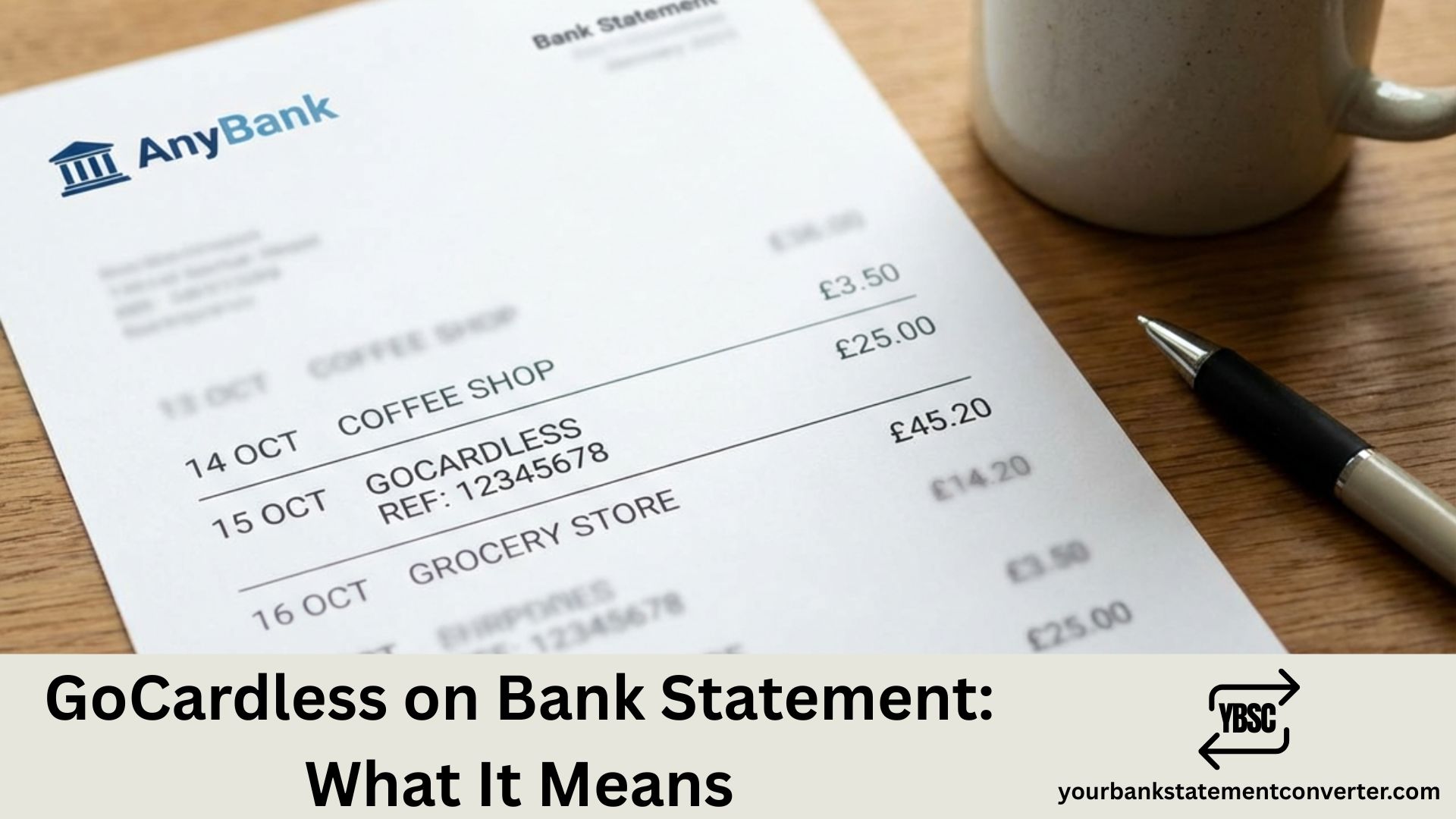

Spotted “GOCARDLESS LTD” on your bank statement and are unsure what it is? This charge appears when a business you’ve authorised collects payment through GoCardless, a third-party Direct Debit payment processor. The company you’re actually paying uses GoCardless to handle their recurring payment transactions.

GoCardless on Bank Statement

GoCardless is a UK-based payment processing company that collects Direct Debit payments on behalf of other businesses. When you see this charge, it means you’ve previously authorised a company to automatically withdraw funds from your account using the Bacs Direct Debit scheme.

Common businesses that use GoCardless include:

- Subscription services (streaming, software, memberships)

- Utility providers

- Gym memberships

- Insurance companies

- SaaS platforms

- Accounting and invoicing services

The charge is legitimate if you’ve signed up for any recurring payment service that uses GoCardless as their payment provider.

How to Identify Who Charged You

Your bank statement reference typically appears in one of these formats:

- GOCARDLESS LTD (standard reference)

- GOCARDLESS-[MERCHANT NAME]-[REFERENCE] (detailed format)

- GoCardless, ref: [UNIQUE CODE] (with mandate reference)

Some banks only display “GOCARDLESS LTD” without additional details. To identify the exact merchant:

- Use the GoCardless Payment Lookup Tool at gocardless.com/payment-lookup

- Enter your bank details and payment reference

- The tool reveals which business collected the payment

If the lookup tool doesn’t return results, contact GoCardless support at help@gocardless.com with your payment date, amount, and mandate reference.

Is the GoCardless Charge Legitimate?

Before disputing the charge, check these common scenarios:

- Forgotten subscription: Review any free trials you signed up for that converted to paid

- Annual renewals: Some services bill yearly and are easy to forget

- Business name mismatch: The trading name may differ from what appears on your statement

- Delayed billing: Some merchants collect payment days after the service date

Check your email inbox for payment notifications from GoCardless—they send advance notice before each collection.

How to Cancel or Get a Refund

To stop future payments:

- Contact the merchant directly to cancel your subscription

- Cancel the Direct Debit through your online banking

- Note: Cancelling the Direct Debit doesn’t cancel your contract with the merchant

To request a refund:

Under the Direct Debit Guarantee, you’re entitled to a full and immediate refund from your bank for any payment taken in error. Contact your bank to initiate a chargeback claim if:

- The payment was taken without valid authorisation

- The amount differs from what you agreed

- You weren’t given proper advance notice

You can claim a refund for unauthorised payments up to 13 months after the charge date.

Managing Your Bank Statement Data

If you’re tracking multiple Direct Debit payments or need to analyse your transaction history, manually sorting through bank statements can be time-consuming.

YourBankStatementConverter.com helps you convert PDF bank statements to Excel format instantly. This makes it easier to:

- Search and filter specific transactions like GoCardless charges

- Track recurring payment patterns

- Reconcile your accounts efficiently

- Identify unfamiliar charges across multiple statements

GoCardless Direct Debit: Key Takeaways

GoCardless on your bank statement indicates a legitimate Direct Debit collection processed through their payment platform. The charge originates from a business you’ve authorised, not from GoCardless itself. Use their payment lookup tool to identify the merchant, and remember you’re protected by the Direct Debit Guarantee for any erroneous charges.

Frequently Asked Questions

Why does my bank statement show GoCardless instead of the company name?

GoCardless processes Direct Debit payments for thousands of businesses. Depending on the merchant’s GoCardless plan and your bank’s display settings, you may only see “GOCARDLESS LTD” rather than the actual business name. Use the payment lookup tool to identify the specific merchant.

Is GoCardless safe and legitimate?

Yes. GoCardless Ltd is authorised by the Financial Conduct Authority (FCA) under the Payment Services Regulations 2017 (registration number 597190). They process payments for over 85,000 businesses worldwide, including well-known brands.

How do I stop GoCardless taking money from my account?

You can cancel the Direct Debit mandate through your online banking at any time. However, this only stops future payments—it doesn’t cancel your contract with the merchant. Contact the business directly to properly cancel your subscription and avoid potential fees.

Can I get my money back from a GoCardless payment?

Yes. Under the Direct Debit Guarantee, your bank must provide an immediate refund for any payment taken in error. For unauthorised payments, you can claim up to 13 months after the charge. Contact your bank’s disputes team to initiate the process.

How long does a GoCardless refund take?

If the merchant processes your refund through GoCardless, it typically takes 2-5 working days to appear in your account. Bank-initiated refunds under the Direct Debit Guarantee are usually immediate.

What does the reference number on my GoCardless payment mean?

The reference contains your mandate ID and helps identify which subscription or service the payment relates to. This reference matches the notification emails GoCardless sends before collecting payment.