Noticed an unfamiliar “InstaMed” charge on your bank or credit card statement? You’re not alone—this is one of the most common questions Americans have when reviewing their financial records.

Quick Answer: InstaMed is a healthcare payment processing company owned by J.P. Morgan that handles medical bill payments for hospitals, clinics, doctor’s offices, and health insurance companies across the United States.

What Is InstaMed on My Bank Statement?

An InstaMed charge on your bank statement represents a payment you made toward a medical bill or healthcare-related expense. InstaMed acts as a third-party payment processor—meaning your payment goes through their system before reaching your healthcare provider.

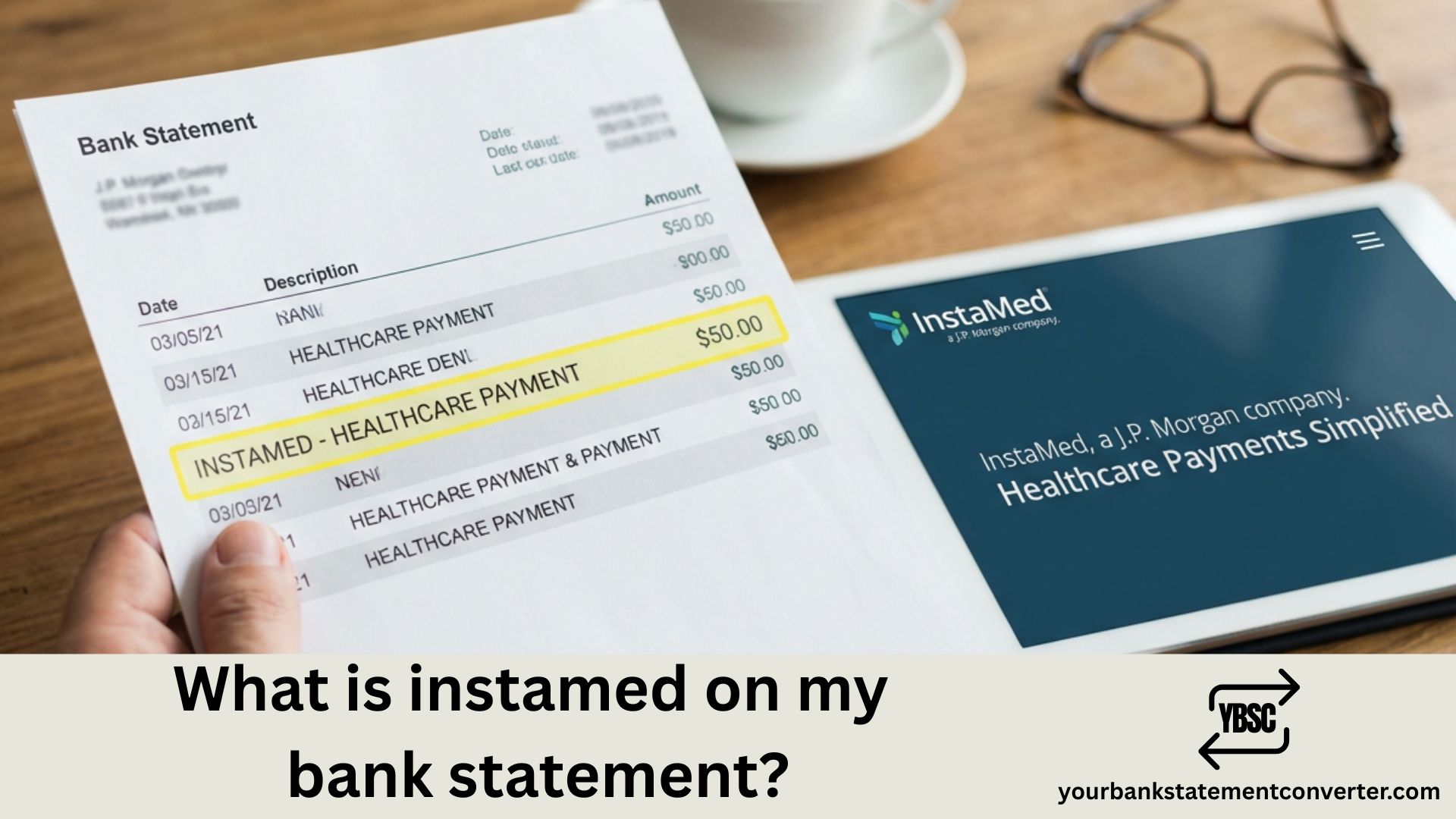

Common InstaMed Bank Statement Descriptors

The charge may appear in several variations:

- INSTAMED

- INSTAMED PAYMENT

- WEB AUTHORIZED PMT INSTAMED

- ACH WITHDRAWAL INSTAMED

- INSTAMED [PROVIDER NAME]

- PAY.INSTAMED.COM

The exact wording depends on your bank’s formatting and how the transaction was processed.

Why Does InstaMed Appear Instead of My Doctor’s Name?

Many healthcare providers—from large hospital networks to small medical practices—use InstaMed to process patient payments. When you pay a medical bill online through a patient portal, by phone, or via automatic payment plan, InstaMed often handles that transaction behind the scenes.

This means your payment went to your healthcare provider, even though “InstaMed” shows up on your statement instead of the provider’s name.

Is InstaMed a Legitimate Charge?

Yes. InstaMed is a legitimate healthcare payment technology company founded in 2004 and acquired by JPMorgan Chase in 2019 for over $500 million. The company processes billions of dollars in healthcare payments annually and works with over 50% of U.S. healthcare provider organizations.

However, if you don’t recognize an InstaMed charge, verify it before assuming it’s legitimate.

How to Verify an InstaMed Charge

Follow these steps to confirm whether an InstaMed transaction is valid:

Step 1: Check Your Email Search your inbox for payment confirmations from InstaMed, your healthcare provider, or your health insurance company.

Step 2: Review Your Medical Bills Look through recent medical bills or Explanation of Benefits (EOB) statements from your insurance for matching amounts.

Step 3: Log Into Patient Portals Access your healthcare provider’s patient portal to view your payment history and outstanding balances.

Step 4: Contact InstaMed Support If you still can’t identify the charge, reach out through pay.instamed.com or contact your healthcare provider directly.

Step 5: Check Family Members Someone in your household may have used your payment method for their medical expenses.

Common Reasons for InstaMed Charges

InstaMed transactions typically result from:

- Doctor’s office copays or visit fees

- Hospital or emergency room bills

- Lab work or diagnostic testing

- Specialist consultations

- Health insurance premium payments

- Prescription costs processed through healthcare systems

- Payment plan installments for medical procedures

- Dental or vision care payments

How to Dispute an Unauthorized InstaMed Charge

If you’ve verified the charge is unauthorized:

- Contact your healthcare provider first—InstaMed is only the payment processor and cannot make account adjustments

- Gather documentation—collect relevant medical bills, EOBs, and bank statements

- Dispute with your bank—file a chargeback if the charge remains unexplained

- Monitor your accounts—watch for additional unauthorized transactions

Organize Your Medical Payments Easily

Tracking healthcare charges across multiple bank accounts and credit cards can be overwhelming—especially when they appear under names like “InstaMed” rather than your actual provider.

If you need to organize, analyze, or convert your bank statements for medical expense tracking, tax preparation, or insurance reimbursement, YourBankStatementConverter.com makes it simple. Convert your PDF bank statements to Excel or CSV format instantly to search, filter, and categorize all your healthcare transactions in one place.

This is particularly useful when you need to:

- Track medical expenses for tax deductions

- Reconcile insurance reimbursements

- Identify recurring subscription charges across multiple accounts

- Prepare documentation for HSA/FSA claims

How to Stop InstaMed Charges

To prevent future InstaMed charges:

- Cancel automatic payment plans through your healthcare provider’s billing department

- Remove saved payment methods from patient portals linked to InstaMed

- Contact your provider to switch to direct billing instead of third-party processing

Understanding InstaMed Charges: Key Takeaways

InstaMed on your bank statement is typically a legitimate healthcare payment—not fraud. The company processes medical payments for thousands of healthcare providers nationwide as part of J.P. Morgan’s healthcare payments network. Always verify unfamiliar charges by checking your medical records and contacting your healthcare provider directly.

For seamless tracking of healthcare payments and other transactions, consider converting your bank statements to a searchable spreadsheet format using YourBankStatementConverter.com—trusted by individuals and finance professionals across the USA for accurate, instant bank statement conversions.

Frequently Asked Questions

What does InstaMed mean on my bank statement?

InstaMed is a J.P. Morgan-owned healthcare payment processor. A charge labeled InstaMed indicates you made a payment toward a medical bill through their platform—used by hospitals, clinics, and health insurance companies.

Is InstaMed a legitimate company?

Yes. InstaMed was founded in 2004 and acquired by JPMorgan Chase in 2019. It processes healthcare payments for over 50% of U.S. healthcare provider organizations and is certified at the highest levels for payment security.

Why was I charged by InstaMed?

You likely paid a medical bill through a healthcare provider’s patient portal, set up an automatic payment plan, or made a payment through your health insurance company’s website—all of which may route through InstaMed.

How do I get a refund from InstaMed?

InstaMed is only the payment processor. Contact your healthcare provider’s billing department directly to request refunds or dispute charges. They control your account balance and can process adjustments.

Can I pay medical bills through InstaMed?

Yes. You can pay healthcare bills at pay.instamed.com if your provider is part of the InstaMed network. You’ll need your statement ID or provider information to make a payment.

How do I cancel InstaMed automatic payments?

Contact your healthcare provider’s billing department to cancel automatic payment plans. You can also remove saved payment methods by logging into the patient portal where you originally set up the payment.

Is an InstaMed charge the same as a medical bill?

Yes—an InstaMed charge represents payment toward a medical bill. The charge appears under InstaMed because they processed the transaction on behalf of your healthcare provider.

What should I do if I don’t recognize an InstaMed charge?

First, search your email for payment confirmations and check recent medical bills. Review patient portals for payment history. If the charge remains unidentified, contact your bank to dispute it as potentially unauthorized.