Noticed an unfamiliar charge on your bank statement with “Norton” or something similar? You’re not alone. Many people get confused when they see cryptic billing descriptors from Norton’s cybersecurity services.

Quick Answer: Norton typically appears on bank statements as NORTON, NORTON*LIFELOCK, NORTON*SUBSCRIPTION, SYMANTEC, NortonLifeLock, or NORTON AP. These are legitimate charges for antivirus software, identity protection, or VPN services from Gen Digital (formerly NortonLifeLock).

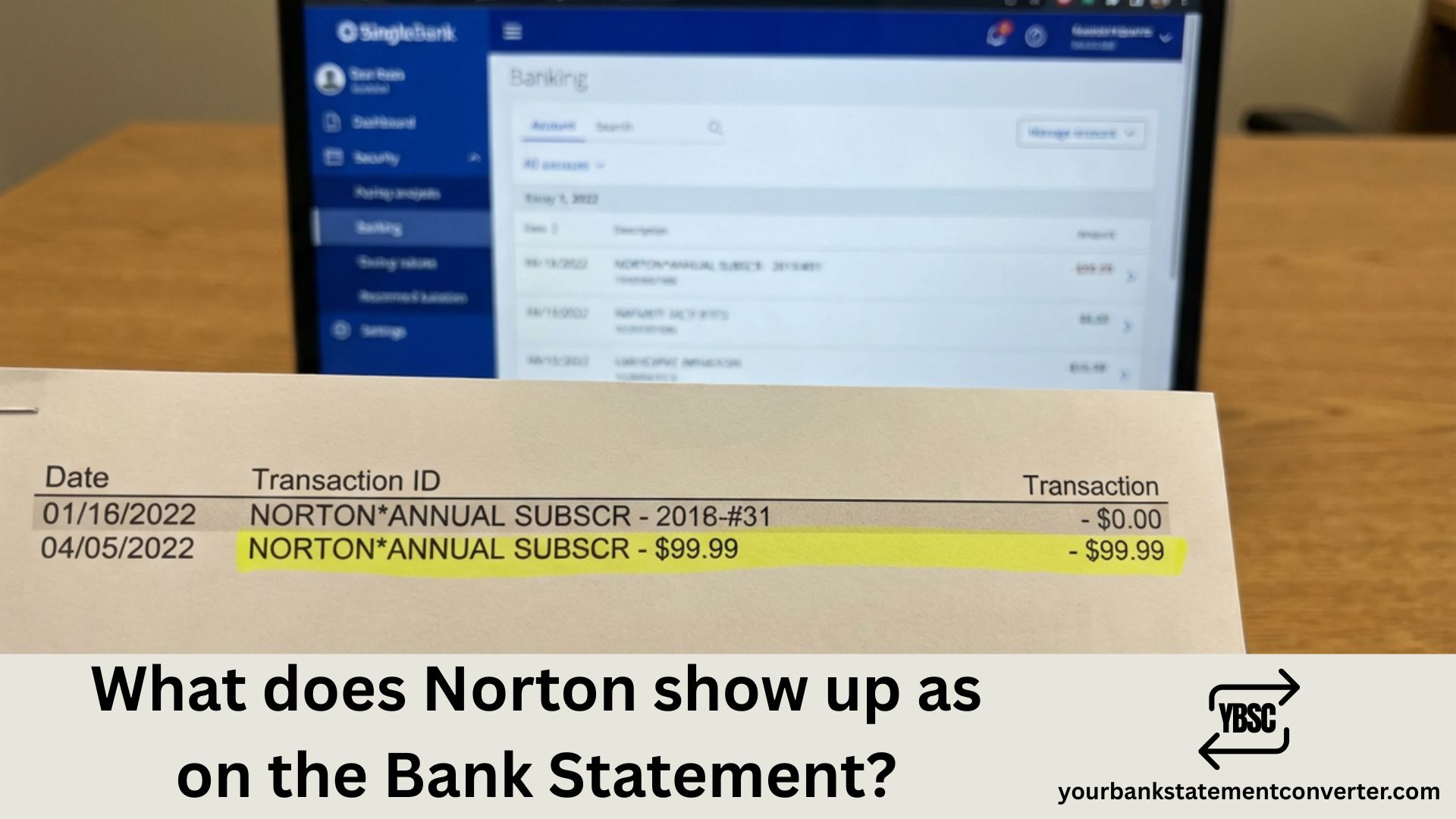

What Does Norton Show Up as on Bank Statement

When Norton charges your credit card or bank account, the transaction descriptor varies based on the product purchased and payment method used. Here are the most common ways Norton charges appear:

| Bank Statement Descriptor | Associated Service |

|---|---|

| NORTON | General Norton subscription |

| NORTON*LIFELOCK | Identity theft protection |

| NORTON*SUBSCRIPTION | Antivirus or security suite |

| NORTON AP | Automatic payment/renewal |

| SYMANTEC | Legacy charges (older accounts) |

| NortonLifeLock | Combined security services |

| NORTON 360 | Full security suite subscription |

| GOOGLE*NORTON | Purchase via Google Play |

The charge amount typically ranges from $10 to $150 depending on whether it’s a monthly or annual subscription.

Why Is Norton Charging My Account?

Common reasons for Norton charges include:

Subscription Renewal – Norton subscriptions auto-renew by default. If you signed up months or years ago, the charge could be an automatic renewal.

Free Trial Conversion – Many users sign up for free trials and forget to cancel before the paid subscription begins.

Family Member Purchase – Someone using your shared payment method may have purchased Norton protection.

New Device Protection – Adding additional devices to your Norton plan can trigger charges.

How to Verify a Norton Charge

If you don’t recognize a Norton charge, follow these steps:

- Log into your Norton account at my.norton.com and check active subscriptions

- Search your email for receipts containing “Norton,” “Symantec,” or “subscription”

- Review the charge amount – Norton plans typically cost $19.99-$149.99 annually

- Contact Norton Support if you still can’t identify the charge

Is the Norton Charge Legitimate or a Scam?

While Norton charges are usually legitimate, beware of phishing scams. Fake Norton emails often claim your subscription renewed for $299-$399 and ask you to call a suspicious number.

Red flags of Norton scams:

- Emails from addresses like norton-alert@billingupdatepro.com

- Urgent threats about immediate charges

- Phone numbers that aren’t official Norton support

- Requests for remote computer access

Legitimate Norton charges will match your subscription history and appear from recognized descriptors listed above.

Need to Convert Your Bank Statement to Another Format?

If you’re reviewing bank statements for Norton charges or reconciling your finances, having your statements in the right format makes analysis much easier.

YourBankStatementConverter.com helps you instantly convert bank statements from PDF to Excel, CSV, or other formats – perfect for tracking subscriptions, identifying charges, and managing your financial records efficiently.

Whether you’re an accountant, bookkeeper, or individual tracking personal expenses, converting bank statements to editable formats lets you:

- Search for specific charges like Norton quickly

- Track recurring subscriptions across months

- Organize financial data for budgeting or tax purposes

👉 Try YourBankStatementConverter.com today

How to Cancel Norton Subscription and Stop Future Charges

To prevent unwanted Norton charges:

- Visit my.norton.com and sign in

- Navigate to Billing or Subscription settings

- Turn off Auto-Renewal

- Confirm cancellation via email

You may be eligible for a refund within 60 days of purchase for annual subscriptions.

Norton Bank Statement Charge: Key Takeaways

Understanding how Norton appears on your bank statement helps you quickly identify legitimate charges versus unauthorized transactions. The most common descriptors are NORTON, NORTON*LIFELOCK, and NORTON AP, all representing subscriptions for antivirus, VPN, or identity protection services from Gen Digital.

If you spot an unrecognized charge, always verify through your Norton account first before disputing with your bank. And for easier financial tracking, consider using YourBankStatementConverter.com to convert your statements into searchable formats.

FAQs

What is Norton*Lifelock charge on my bank statement?

NORTON*LIFELOCK is a billing descriptor for Norton’s identity theft protection service. This charge appears when you have an active LifeLock subscription that monitors your personal information and alerts you to potential identity fraud.

Why am I being charged by Norton when I didn’t sign up?

You may have activated a free trial that converted to a paid subscription, or a family member using your payment method purchased Norton. Check your email for signup confirmations and log into my.norton.com to verify active subscriptions.

How do I get a refund from Norton?

Contact Norton customer support within 60 days of your annual subscription charge or within 14 days for monthly plans. Log into your account, navigate to billing history, and request a refund through their support chat or phone line.

What does Norton AP mean on my credit card?

Norton AP stands for “Automatic Payment.” This descriptor appears when Norton automatically renews your subscription using saved payment details.

Is a $0 Norton charge on my statement a scam?

A $0 charge is typically an authorization hold to verify your payment method before the actual billing occurs. However, if you never signed up for Norton, contact your bank and Norton support immediately as someone may be testing stolen card details.

How do I stop Norton from charging my credit card?

Log into my.norton.com, go to Subscription settings, and disable Auto-Renewal. You can also remove your saved payment method from your Norton account to prevent future charges.

What is the difference between Norton and Symantec charges?

Symantec was Norton’s parent company until 2019 when it rebranded to NortonLifeLock (now Gen Digital). Older accounts or legacy subscriptions may still show SYMANTEC as the billing descriptor instead of NORTON.