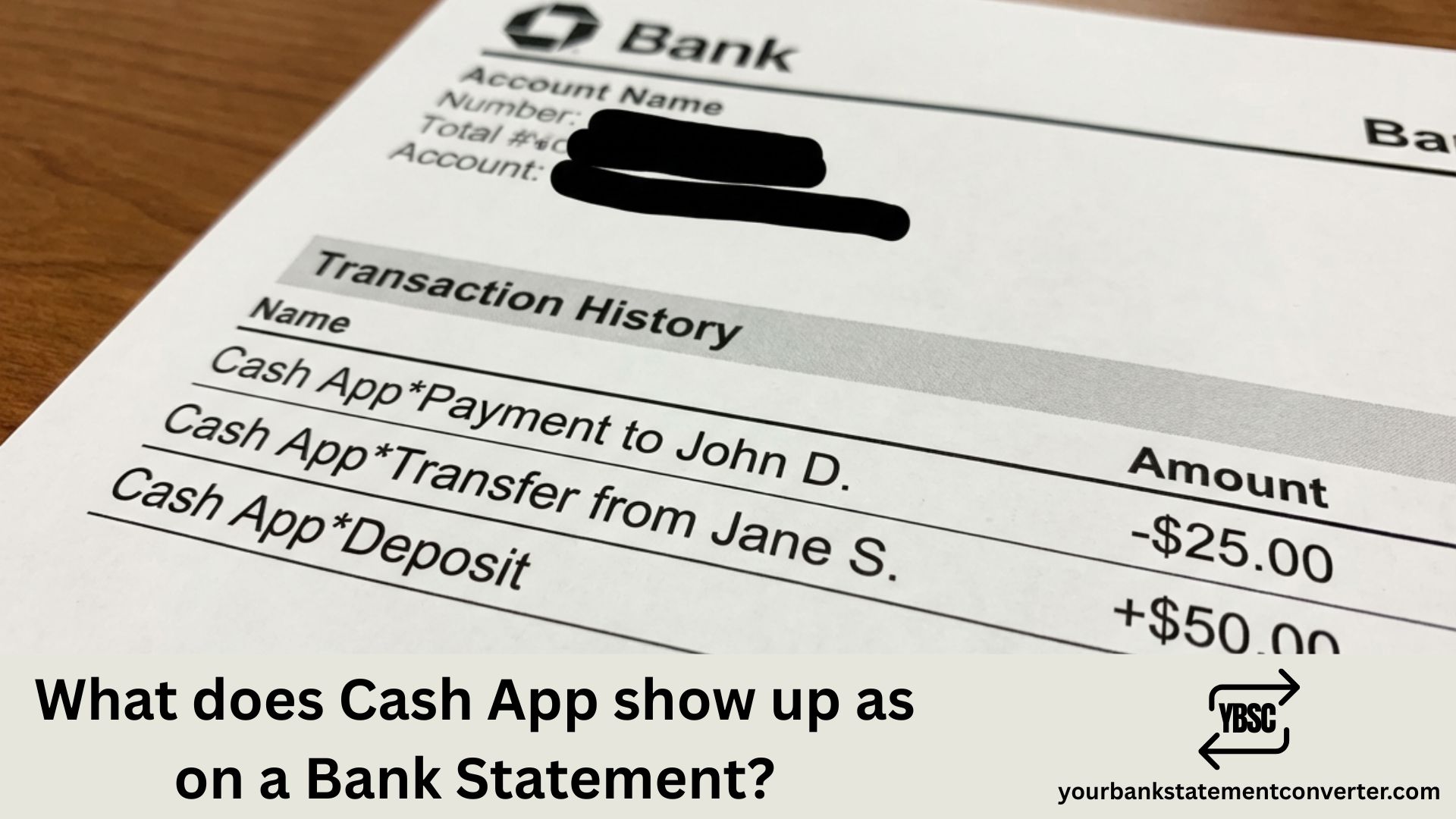

Cash App transactions can appear under several different names on your bank or credit card statement, depending on whether you’re adding money, receiving funds, making purchases, or using Cash App Pay. Since Cash App is owned by Block, Inc. (formerly Square, Inc.), transaction descriptors often reference these parent company names—which can be confusing when you’re trying to reconcile your accounts or track specific payments.

What Does Cash App Show Up As on Bank Statement?

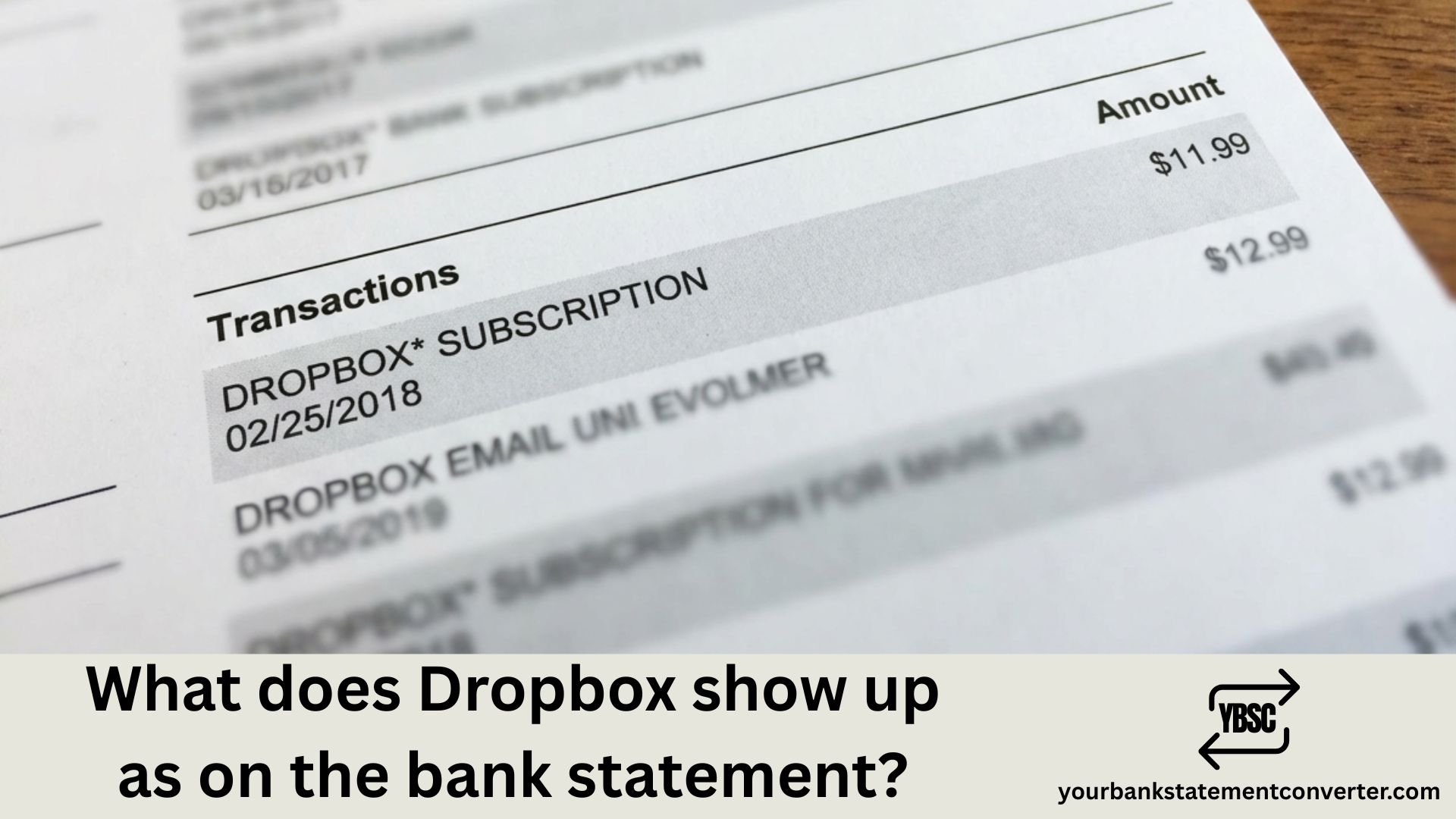

Cash App typically appears on bank statements with these common descriptors:

Most frequent formats:

- CASH APP or CASH APP*

- CASH APP*[username or name]

- SQC*CASH APP (Square Cash)

- SQ*CASH APP

- SQUARE INC CASH APP

- CASH APP*CASH OUT

- CA*[merchant name] (for Cash App Pay purchases)

- CASH APP 800-969-1940 (customer service number)

For adding money to Cash App (Cash In):

- CASH APP*CASH IN

- SQC*CASH APP CASH IN

- CASH APP [last 4 digits of card]

For withdrawing to bank (Cash Out):

- CASH APP*CASH OUT

- CASH APP INSTANT (for instant transfers)

- SQ*CASH APP TRANSFER

For peer-to-peer payments:

- CASH APP*[recipient’s name or $cashtag]

- SQC*[name]

- CASH APP P2P

For Cash App Card purchases:

- CK*[merchant name]

- CASH APP*[merchant name]

- SQ*[merchant name]

The exact descriptor varies based on transaction type, your bank, and whether you’re sending money, receiving funds, making purchases with your Cash App Card, or using Cash App Pay at checkout.

Common fees that might appear:

- $0.25–$1.75 – ATM withdrawal fees (plus possible ATM operator fees)

- 1.5%–3% – Instant transfer fees

- 3% – Credit card funding fee

Finding Cash App Transactions Buried in Your Bank Statements?

With Cash App using multiple descriptors like “SQCCASH APP,” “SQUARE INC,” and “CA[merchant],” tracking your peer-to-peer payments, card purchases, and transfers across PDF bank statements becomes a frustrating puzzle. Different transaction types show up differently, making reconciliation a headache.

YourBankStatementConverter.com converts your bank statement PDFs into clean, searchable Excel spreadsheets within seconds. Simply upload your statements, then search for “CASH APP,” “SQC,” or “SQUARE” to instantly find every Cash App transaction—organized, sortable, and ready for review.

Ideal for:

- Tracking all peer-to-peer payments sent and received

- Reconciling Cash App Card spending with your bank records

- Identifying Cash App fees and transfer charges

- Preparing financial records for budgeting or taxes

👉 Convert your statements free at YourBankStatementConverter.com

FAQs

Why does my statement say “SQC” or “SQUARE” instead of Cash App?

Cash App is owned by Block, Inc., formerly known as Square, Inc. The “SQC” stands for “Square Cash,” which was Cash App’s original name. Many banking systems still use these legacy descriptors, so “SQC*CASH APP” and “SQUARE INC CASH APP” are legitimate Cash App transactions.

What does “CASH APP*CASH OUT” mean on my statement?

This indicates you transferred money from your Cash App balance to your linked bank account. “Cash Out” is Cash App’s term for withdrawing funds to your external bank. If you chose instant transfer, you might also see “CASH APP INSTANT.”

Why do I see “CK” or “CA” followed by a merchant name?

When you use your Cash App Card (Cash Card) or Cash App Pay to make purchases at stores or online retailers, the transaction appears with “CK*” or “CA*” followed by the merchant name. This distinguishes card purchases from peer-to-peer transfers.

I see a Cash App charge I don’t recognize. What should I do?

First, open your Cash App and review your transaction history for the matching amount and date. Check if a linked contact sent you a payment request you accidentally approved. If the charge is truly unauthorized, report it immediately through Cash App (Profile > Support > Report a Payment Issue) and contact your bank to dispute the charge.

What does the phone number 800-969-1940 on my Cash App charge mean?

Some banks include the merchant’s customer service number in transaction descriptors. 800-969-1940 is Cash App’s official support line, confirming the transaction is legitimately from Cash App.

Why was I charged a fee for transferring money?

Cash App charges fees for certain services: instant transfers to your bank (1.5%–3%), sending money via credit card (3%), and ATM withdrawals ($2–$2.50 plus any ATM operator fees, though fee-free ATMs are available with direct deposit). Standard bank transfers typically take 1–3 business days but are free.

How can I tell the difference between money I sent vs. money I added?

“CASH APP*[name]” or “SQC*[name]” typically indicates peer-to-peer payments. “CASH APP*CASH IN” shows you added money to your Cash App balance from your bank. Check amounts and dates against your in-app transaction history for confirmation.

Why do some Cash App transactions show a person’s name?

When you send money to someone via Cash App, the recipient’s name or cashtagmayappearinthetransactiondescriptor(e.g.,”CASHAPP∗JOHNDOE”or”CASHAPP∗johndoe”). This helps you identify who received the payment.

Do Cash App transactions show up immediately on my bank statement?

Most Cash App transactions appear as pending within minutes and post within 1–3 business days. Instant transfers show up faster. However, statement timing depends on your bank’s processing schedule—some transactions may not appear on your statement until the next billing cycle.

How can I easily track all my Cash App activity alongside other expenses?

Upload your bank statements to YourBankStatementConverter.com and convert them to searchable Excel files. Search for “CASH APP,” “SQC,” “SQUARE,” or “CK*” to see every Cash App transaction in one organized spreadsheet—perfect for tracking peer-to-peer payments, card purchases, and transfers across multiple months.